SOLUTIONS: PAYMENTS & COLLECTIONS

Payments & Collections Solutions to Keep Cashflow Moving

Late payments and inefficient collections slow down your lending business. Infinity’s payments & collections solution automates payment processing, reduces delinquency, and ensures regulatory compliance—so you get paid faster and more reliably.

FULLY AUTOMATED PAYMENTS & COLLECTIONS

OFFER MULTIPLE, EASY PAYMENT OPTIONS

REDUCE DEFAULT RATES & BOOST REVENE

Simplify & Accelerate

Loan Payments & Collections Processes

Seamless

Payment Processing

Accept ACH, debit/credit cards, remote checks, and digital wallets with secure, built-in payment processing.

Automated

Recurring Payments

Reduce missed payments by enabling borrowers to schedule auto-pay, set reminders, and customize repayment plans.

AI-Powered

Collection Workflows

Automatically trigger past-due notices, follow-ups, and custom collection strategies to recover funds efficiently.

Built-In

Compliance Security

Stay compliant with PCI DSS, TILA, AML, and Fair Lending regulations, ensuring secure and legally sound transactions.

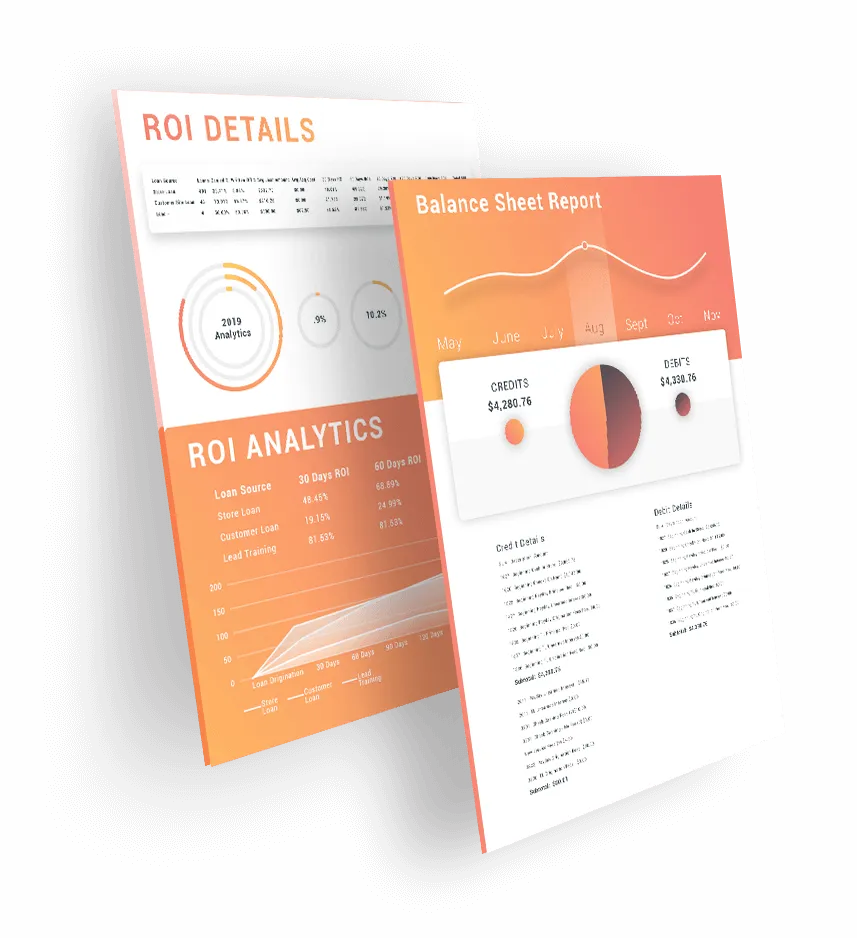

Real-Time Payment Tracking & Reporting

Monitor payments, settlements, and borrower trends with live analytics and automated reporting.

Self-Service

Borrower Portal

Let borrowers manage payments, update billing details, and track repayment progress without contacting your team.

Loan Payments & Collections Solutions

Perfect for Short-Term Lenders

Automate approvals, payments, and compliance tracking for installment loans.

Optimize credit line extensions and borrower risk assessments in real time.

Provide fast, digital lending experiences with AI-powered decisioning.

Manage collateral-based lending with automated valuation and repayment tracking.

Ensure compliance and maximize efficiency with built-in regulations and reporting.

Facilitate credit services organization (CSO) and credit access business (CAB) lending with compliance-focused automation and flexible loan structuring.

What's at Stake?

THE WRONG LOAN PAYMENTS OR COLLECTIONS TOOLS PUT LENDERS AT SERIOUS RISK.

Manual Payment Processes = Higher Delinquency Rates

Lenders who manually track payments experience more late payments and missed borrower commitments.

Limited Payment Options = Lost Customers

Without ACH, digital wallets, and flexible installment plans, borrowers may seek more convenient lenders.

Slow Collections = Reduced Profitability

Lenders without automated collections workflows struggle to recover funds efficiently, cutting into revenue.

Compliance Gaps = Risk of Costly Fines

Non-compliance with payment regulations and data security standards can lead to penalties, lawsuits, and reputational damage.

Put loan payments and collections on autopilot. Start today!

Frequently Asked Questions

QUESTIONS ABOUT INFINITY'S LOAN PAYMENT OR COLLECTIONS TOOLS?

Question 1: How does Infinity's end-to-end lending solutions improve efficiency?

By automating loan origination, servicing, payments, and collections in one platform, Infinity reduces manual work and speeds up processing times.

Question 2: Can I configure workflows and approval rules to fit my business?

Yes. Infinity’s fully configurable platform allows you to set custom workflows, loan structures, and risk thresholds.

Question 3: Does Infinity integrate with payment processors and CRMs?

Absolutely. Infinity seamlessly connects with your existing systems, including payment gateways, CRMs, and accounting tools.

Question 4: How does Infinity help with compliance tracking?

Our software automatically tracks regulatory changes and generates audit-ready reports to keep you compliant.

Question 5: Can I get real-time insights into my loan portfolio?

Yes. Infinity provides real-time dashboards, borrower analytics, and 400+ customizable reports for complete visibility.

HAVE MORE QUESTIONS? CONTACT US AND GET ANSWERS FROM DEDICATED LENDING EXPERTS.

Unify Your Lending Process & Optimize Your KPIs

One platform, maximum automation and configurability, unlimited growth potential.

1 (954) 678-4600

1200 SW 145th Avenue

Suite 310

Pembroke Pines, FL. 33027

United States

Want to See More?

Follow & Subscribe on our Socials!

Solutions

Loan Types

Sister Links

Company

Resources

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved