Imagine Short-Term Lending More Automated, With Less Risk and Limitless Scalability

INFINITY SOFTWARE IS MORE THAN A LOAN MANAGEMENT SYSTEM;

IT'S A GROWTH ENGINE AND DEDICATED PARTNER FOR SHORT-TERM LENDERS.

“From In-Line to Online”

The Infinity Lending Package Is Here

The complete roadmap to help lenders confidently scale online without losing the personal touch.

Created by lending experts, the Infinity Package gives you everything you need to move into digital lending with ease, security, and speed.

Fully branded online lending platform

Compliant workflows for Texas and storefront lenders

Loan doc e-signatures and automation

Your own website (built for you)

Weekly training + expert onboarding

Direct access to our industry-leading support team

Join hundreds of forward-thinking lenders who are already future-proofing their business.

Designed for Lenders Who Want Control

Infinity puts you in the cockpit.

Configure Everything.

No Tech Skills Needed.

Set up loan products tailored to your business and borrowers. Adjust terms, interest rates, repayment schedules, and compliance rules—all at the click of a button.

Autopilot:

Set it & Forget it.

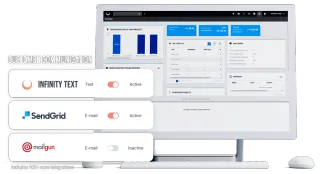

Free yourself from repetitive tasks with seamless automation for loan origination, payments, collections, and more. Plus, integrate with the tools you already use to keep everything running smoothly.

Automatically Adapt to New Regulations

Whether it’s new regulations, shifting market demands, or your next big idea, Infinity makes it easy to pivot without skipping a beat.

Integrate with the Tools You Already Use

Connect Infinity seamlessly with nearly 100 business tools, including CRMs, payment processors, marketing platforms, and more—keeping everything in sync.

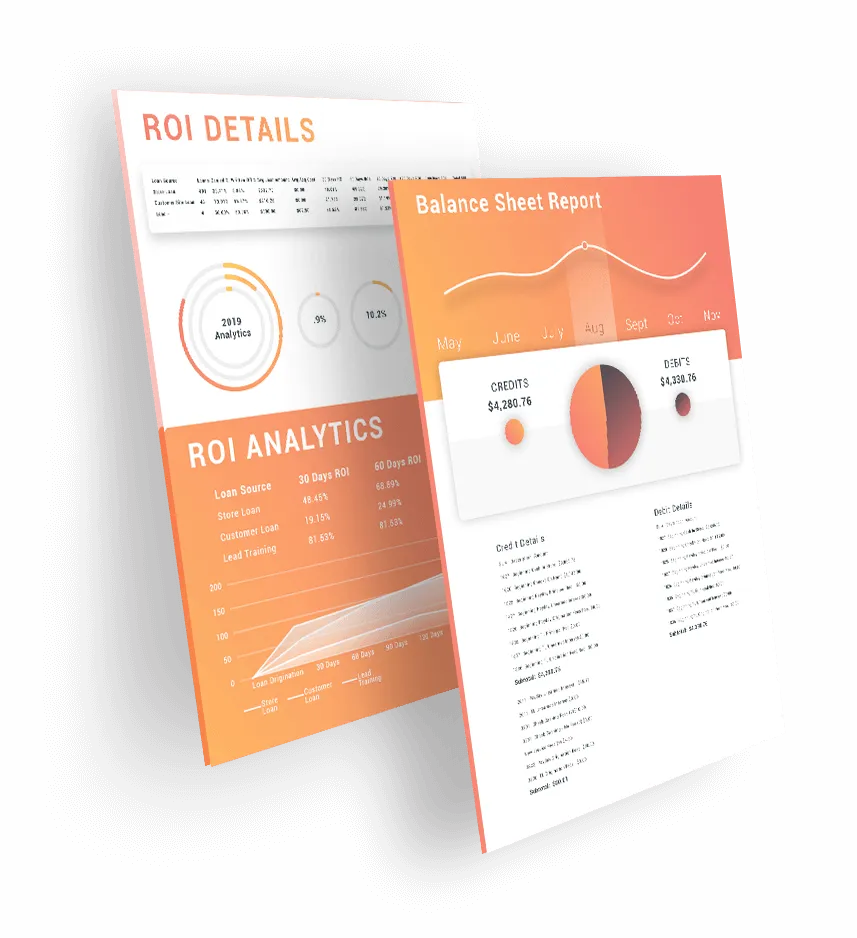

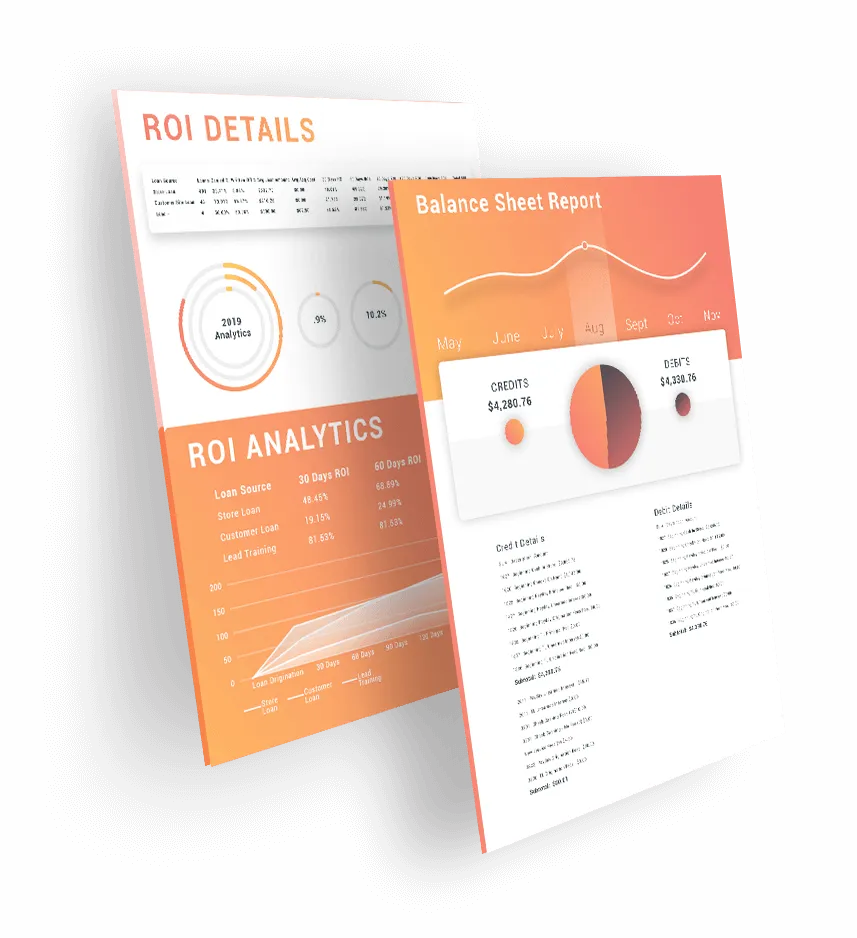

Optimize Lead Performance & ROI

Leverage advanced lead scoring and waterfall technology to identify top-performing lead sources, reduce acquisition costs, and maximize funded loans.

Lending Software That Works As Hard As You Do

Trusted by the lending industry, Infinity is the go-to platform for lenders who want more.

MORE Automation, MORE Customization, MORE Control.

Watch this quick 60-second video that walks you through how Infinity streamlines the entire loan lifecycle, adapts to your exact process, and keeps you compliant without slowing you down.

Whether you're growing storefronts or scaling online, Infinity is built to evolve with your business, not against it.

🚀 See what’s possible when your software pulls its weight.

WHAT IS INFINITY SOFTWARE?

A TRUE, ALL-IN-ONE LOAN MANAGEMENT SYSTEM

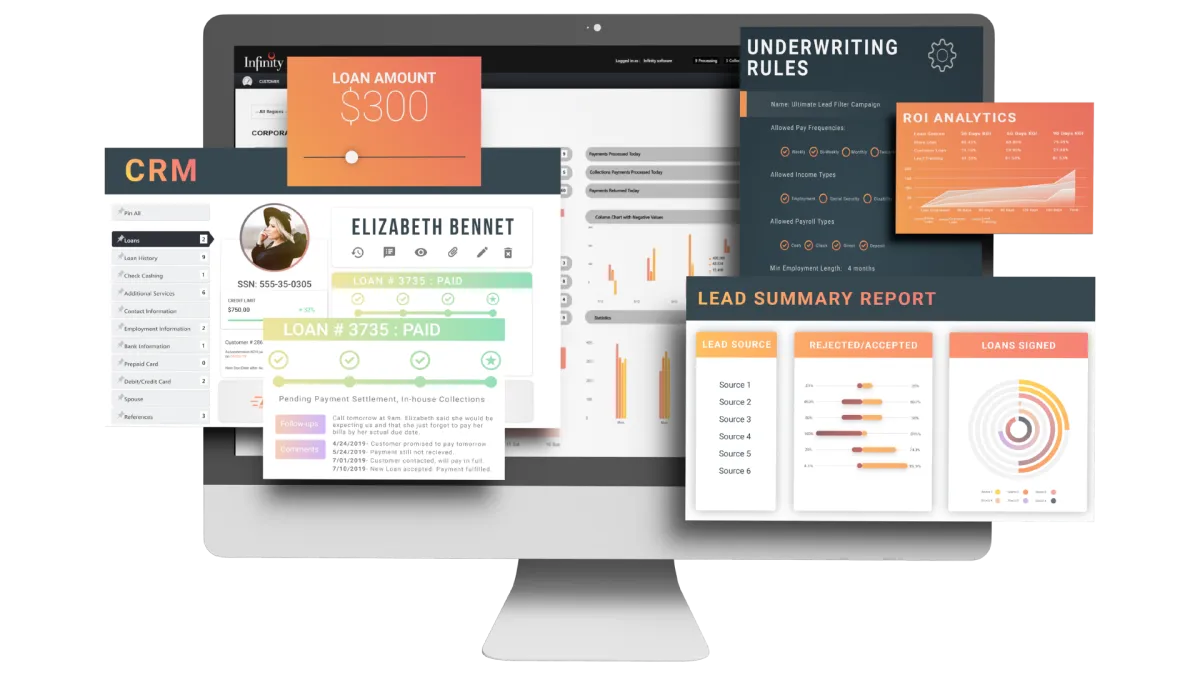

CRM

Feature rich customer relationship software simplifies handling customer interactions with current and potential customers. Many needed daily activities are automated to ensure their completion and save vital employee time. Other tasks are simplified for quick completion.

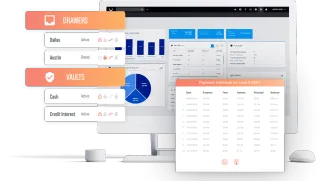

DASHBOARDS

Power your business with actionable advanced analytics. Interactive real time dashboards enable your business to operate at maximum speed. Create department-specific dashboards based on key performance indicators that managers need when making decisions

MOBILE TECHNOLOGY

Expand your market reach without additional overhead expenses. Receive loan applications from customers when and where they have time to apply. Lenders remain in control of all loan underwriting and loan approvals. Mobile initiated payments is another tool all lenders need.

CUSTOMER PORTAL

Lending is becoming a more and more technology dependent industry. Customers are requiring lending solutions that are convenient, secure, and easy to access. Our customer portals allow customers to apply for loans at the comfort of their home, upload any needed loan documents, and make their loan payments.

ANALYTICS

Knowing what traits your best customers share reduces the cost of future lead purchases. Our robust data analytics to even non-technical users through its set of tools and features. Advanced features and data is available for lenders who want to A/B test against different data files.

UNDERWRITING

Make accurate automated underwriting decisions based on combined business rules with credit agency reporting. Or use our dynamic workflows and advanced analytics to improve the quality of manual loan underwriting. Streamline your lending business with clear loan underwriting.

LEAD MANAGEMENT

Maximize your lead buying, underwrite and score potential customers before investing in a lead. Our lead waterfall technology allows you to complete a deep analysis on loan applications before a purchase is made. Know the cost of funded loans and who your best lead providers are for the best growth of your company.

Texas CSO & CAB Lending

FREE Starter Kit

Navigating Texas CSO/CAB compliance can feel overwhelming — whether you're just starting out or expanding your operation across state lines. The 2025 CSO & CAB Lending Starter Kit gives you the clarity, tools, and confidence to move forward fast.

What's inside?

Up-to-date compliance checklist

Every required form, linked and ready

Expert insights to avoid shutdowns and missed revenue

WHAT IS INFINITY?

A TRUE, ALL-IN-ONE LOAN MANAGEMENT SYSTEM

CRM

Feature rich customer relationship software simplifies handling customer interactions with current and potential customers. Many needed daily activities are automated to ensure their completion and save vital employee time. Other tasks are simplified for quick completion.

DASHBOARDS

Power your business with actionable advanced analytics. Interactive real time dashboards enable your business to operate at maximum speed. Create department-specific dashboards based on key performance indicators that managers need when making decisions

MOBILE TECHNOLOGY

Expand your market reach without additional overhead expenses. Receive loan applications from customers when and where they have time to apply. Lenders remain in control of all loan underwriting and loan approvals. Mobile initiated payments is another tool all lenders need.

CUSTOMER PORTAL

Lending is becoming a more and more technology dependent industry. Customers are requiring lending solutions that are convenient, secure, and easy to access. Our customer portals allow customers to apply for loans at the comfort of their home, upload any needed loan documents, and make their loan payments.

ANALYTICS

Knowing what traits your best customers share reduces the cost of future lead purchases. Our robust data analytics to even non-technical users through its set of tools and features. Advanced features and data is available for lenders who want to A/B test against different data files.

UNDERWRITING

Make accurate automated underwriting decisions based on combined business rules with credit agency reporting. Or use our dynamic workflows and advanced analytics to improve the quality of manual loan underwriting. Streamline your lending business with clear loan underwriting.

LEAD MANAGEMENT

Maximize your lead buying, underwrite and score potential customers before investing in a lead. Our lead waterfall technology allows you to complete a deep analysis on loan applications before a purchase is made. Know the cost of funded loans and who your best lead providers are for the best growth of your company.

Boost Compliance, Efficiency and Profitability for Your Lending Business

Stay Compliant

Automatically

Never worry about changing regulations again.

Save LOTS of

Time

Automate and streamline tedious manual processes.

Maximize

Profitability

Make data-driven decisions to grow your lending business.

Ready to launch?

We understand the challenges you face as a lender.

Managing complex compliance requirements.

Losing time to inefficient manual processes.

Struggling to reduce loan default rates.

Staying competitive in a fast-paced market.

Infinity Software eliminates these pain points so you can focus on what matters — growing your business.

Trusted by the Best in Lending

— John Humphrey, COO DMP Investments

Your software platform provided the ideal mix of processing capacity, high availability, and resource scalability that each proved vital components throughout our...

— Dustin Dernier, CEO 605 Lending

"Infinity Software is forever evolving and is a breeze to learn and use! The Infinity Team has helped us grow our start up into something to be very proud of. The entire team has been there for us every step of the way. We appreciate all of you!!"

—Lou Vena, COO

Tech Processing & Servicing

“I’m extremely happy with the system, there is a level of automation that reduces our reliance on staff and leads to a much more efficient business."

It's time to start scaling.

EVERYTHING YOU NEED TO RUN YOUR LENDING BUSINESS IN ONE PLATFORM.

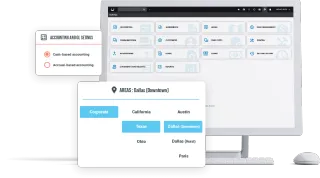

CREATE YOUR LOAN PRODUCTS

Easily set up your loan products and business rules for each product, area, state, city, or region that you lend in. Infinity is the only platform that gives you such granular control over what, where, and how you lend.

CONNECT WITH YOUR WEBSITE OR STOREFRONT

We connect our platform to your current site or build you a new one specifically designed to sell your loan products. If you lend in a store, you can use our cloud-based system right in your store with ease. Give your customers an experience they will love.

MARKET AND SELL

Get all the marketing tools, integrations, and payment processors you need to promote your business, lend more, and build relationships with raving fan-customers who keep coming back for more. With our platform, you’ll join a community that has already earned over $7 billion from lending.

SUPPORT YOUR CUSTOMERS

When your customers thrive, so does your business. Use our robust suite of customer-focused features, including our simplified application process, beautiful customer account area, and all of the tracking and follow up tools you need to ensure that your customers are happy and successful.

COLLECT AND GROW

As your collection rates soar, so will your profitability and growth. Leverage Infinity’s built-in collection tools and integrations to improve collections. Set up collection tiers, build automated collections workflows, and create flexible payment plans to help your customers get back on track.

Power Up Your Lending with

LendSuite Premier Marketplace

Infinity Software is the most powerful Loan Management System on the market - made even stronger with LendSuite Premier Marketplace, your hub for seamless integrations. From payment processing to credit reporting and compliance, our trusted partners help lenders streamline operations, reduce risk, and grow their businesses.

Featured Marketplace Partners

Explore all integrations and see how LendSuite Premier Marketplace enhances Infinity’s capabilities for a smarter, more efficient lending experience.

TRANSITION YOUR LENDING

BUSINESS TO INFINITY TODAY

Join our long list of successful clients that have built massively successful companies.

1 (954) 678-4600

1200 SW 145th Avenue

Suite 310

Pembroke Pines, FL. 33027

United States

Want to See More?

Follow & Subscribe on our Socials!

Solutions

Loan Types

Sister Links

Company

Resources

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved