SOLUTIONS: END-TO-END LENDING

Smarter, Faster, and Fully Automated Lending—All in One Platform

Managing the entire loan lifecycle—from origination to servicing to repayment—shouldn’t be a challenge. Infinity’s end-to-end lending solution streamlines every step with automation, AI-powered decisioning, and built-in compliance, so you can scale faster, reduce risk, and maximize profitability.

ONE PLATFORM FOR THE ENTIRE LOAN CYCLE

AUTOMATE LENDING FROM APPLICATION TO REPAYMENT

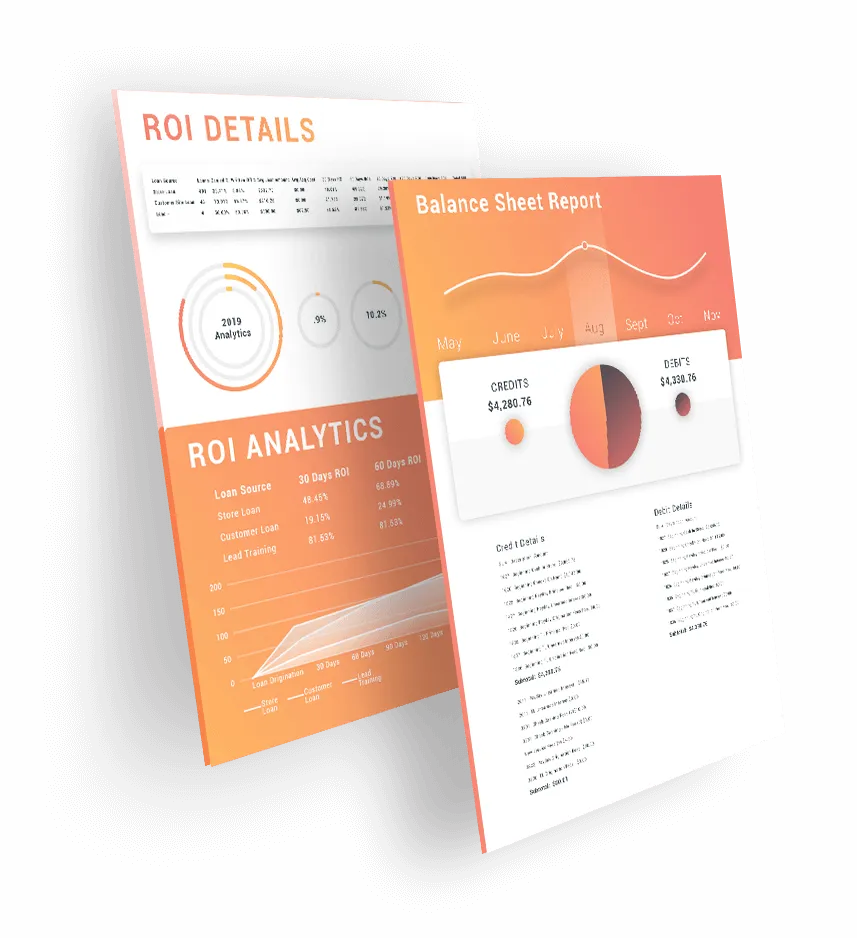

OPTIMIZE PERFORMANCE WITH REAL-TIME ANALYTICS

One System, End-to-End Loan Management

Powerful

Loan Origination

From lead capture to funding, automate applications, underwriting, and approvals with AI-driven decisioning and instant verification.

Smart Loan Servicing &

Collections

Automate billing, payment processing, and past-due notifications while giving borrowers flexible self-service options.

Compliance &

Risk Management

Stay ahead of TILA, AML, Fair Lending, and other regulations with automated tracking, reporting, and audit-ready documentation.

Omnichannel

Borrower Engagement

Engage borrowers across email, SMS, and online portals with automated reminders, account updates, and retention campaigns.

Configure Workflows for Maximum Efficiency

Adapt Infinity’s platform to match your unique lending model—set custom loan structures, approval rules, and repayment terms.

Better Reporting &

Analytics

Gain real-time insights into loan performance, borrower behavior, and revenue trends with 400+ customizable reports (and growing).

End-to-End Lending Solutions for

All Popular Loan Types

Automate approvals, payments, and compliance tracking for installment loans.

Optimize credit line extensions and borrower risk assessments in real time.

Provide fast, digital lending experiences with AI-powered decisioning.

Manage collateral-based lending with automated valuation and repayment tracking.

Ensure compliance and maximize efficiency with built-in regulations and reporting.

Facilitate credit services organization (CSO) and credit access business (CAB) lending with compliance-focused automation and flexible loan structuring.

What's at Stake?

USING MULTIPLE TOOLS OR SYSTEMS TO MANAGE LOANS COME WITH A LOT OF COMPLEXITY AND RISK.

Disconnected Systems = Operational Inefficiency

Managing multiple platforms for origination, servicing, and collections slows you down and increases errors.

Manual Compliance = Costly Risks

Without automated compliance tracking, regulatory mistakes can lead to fines and legal exposure.

Lack of Optimization = Lost Revenue

A slow, manual lending process costs you high-intent borrowers and limits scalability.

Data Silos = Missed Insights

Without a centralized platform, lenders struggle to track performance, risk, and profitability.

Manage your loan products from origination, to funding, to collections, to marketing, and beyond. Start today!

Have Questions? We’ve Got Answers!

Check out our FAQs for quick answers. Need additional help? Chat with us or schedule a demo to learn more about how our solution fits your lending needs.

What is end-to-end lending software?

End-to-end lending software is an all-in-one platform that manages the complete loan lifecycle from loan origination and underwriting to servicing and collections. Infinity Software’s end-to-end lending solution helps lenders automate every stage, ensuring accuracy, compliance, and faster loan processing.

How does Infinity Software simplify end-to-end lending?

Infinity Software integrates loan origination, management, and servicing into one centralized system. This allows lenders to handle applications, approvals, repayments, and compliance from a single dashboard, eliminating manual work and improving borrower satisfaction.

What are the key benefits of using Infinity Software’s end-to-end lending software?

Infinity Software’s end-to-end lending software helps lenders streamline workflows, reduce turnaround time, and enhance data accuracy. With Infinity Software, lenders gain full visibility across the lending process, minimize operational costs, and provide a seamless digital experience for borrowers.

Can Infinity Software support multiple loan products?

Yes. Infinity’s end-to-end lending software supports various loan types, including installment, payday, consumer, line-of-credit, and auto-title loans. The platform can be customized to match any lender’s business model and compliance needs.

How does Infinity’s end-to-end lending solution ensure compliance?

Infinity Software is designed with built-in compliance tools that align with federal, state, and local regulations. It automatically updates audit logs, ensures transparent borrower communication, and helps lenders stay compliant throughout the lending process.

Is Infinity’s end-to-end lending software cloud-based?

Absolutely. Infinity Software is a cloud-based platform that allows lenders to manage operations securely from anywhere. It offers scalability, real-time data access, and zero downtime for business continuity.

Can Infinity Software integrate with third-party platforms?

Yes. Infinity’s end-to-end lending system supports API integrations with credit bureaus, payment processors, CRM systems, and analytics tools, enabling lenders to create a fully connected lending ecosystem.

Why choose Infinity Software for end-to-end lending automation?

Infinity Software stands out for its flexibility, automation, and scalability. It’s built for lenders who want to manage their entire lending operation from borrower onboarding to loan closure within a single, efficient platform.

Unify Your Lending Process & Optimize Your KPIs

One platform, maximum automation and configurability, unlimited growth potential.

1 (954) 678-4600

1200 SW 145th Avenue

Suite 310

Pembroke Pines, FL. 33027

United States

Want to See More?

Follow & Subscribe on our Socials!

Solutions

Loan Types

Sister Links

Company

Resources

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved