SOLUTIONS: LOAN SERVICING

Loan Servicing: Automate & Simplify Loan Management

Lenders need more than just a system to collect payments—they need a scalable, automated solution that maximizes borrower retention, ensures compliance, and streamlines operation.

AUTOMATED BILLING & PAYMENT PROCESSING

STREAMLINE COLLECTIONS & REDUCE DELINQUENCIES

ENSURE 100% COMPLIANCE WITH BUILT-IN SAFEGUARDS

Effortless Loan Servicing &

Smarter, Faster Lending

Automated Billing & Payment Processing

Collect payments seamlessly with auto-debit, online payments, and real-time transaction tracking. Set up custom payment plans, recurring billing, and automated reminders to reduce delinquencies.

Self-Service

Borrower Portal

Empower borrowers with a self-service portal where they can make payments, check balances, update details, and request modifications—all without calling your team.

Compliance & Regulatory Safeguards

Stay 100% compliant with TILA, CFPB, AML, Fair Lending, and state regulations. Automated compliance tracking & audit-ready reporting keep you ahead of regulatory changes.

Collections &

Delinquency

Reduce missed payments with smart payment reminders, automated late-fee assessments, and intelligent collections workflows—so your revenue stays predictable.

Seamless Integrations for Smooth Workflow

Infinity connects effortlessly with banking platforms, payment processors, credit bureaus, and CRMs, ensuring a frictionless loan servicing experience from start to finish.

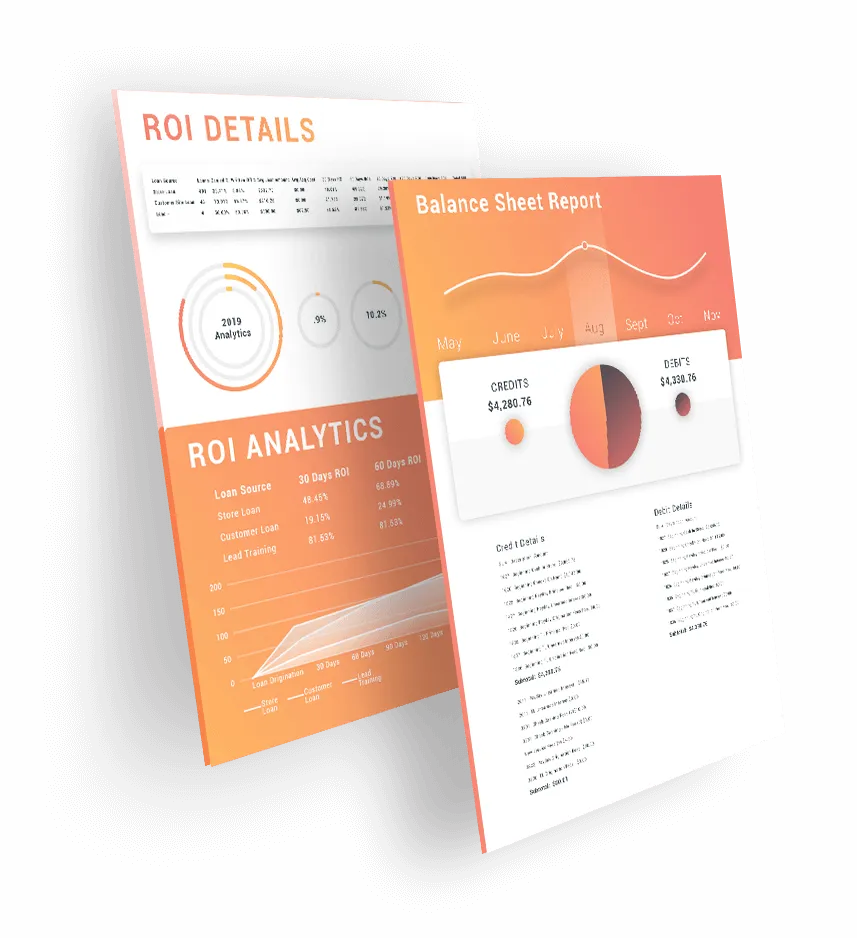

Advanced Reporting & Portfolio Insights

Gain full visibility into loan performance with real-time reporting, portfolio analytics, and borrower trends. Track key metrics, reduce risk, and optimize servicing strategies with AI-powered insights.

Loan Servicing Software Built for a

Variety of Short-Term Lenders

Automate in-person payment collections & customer notifications.

Digital-first servicing with AI-powered automation & borrower self-service tools.

Seamless integration for managing both in-person & online loan servicing.

Automate recurring payments, reminders, & borrower communication.

Real-time balance adjustments & flexible repayment tracking.

Real-time balance adjustments & flexible repayment tracking.

What's at Stake?

LENDER WHO CHOOSE LOAN MANAGEMENT SOFTWARE WITH DATED LOAN ORIGINATION TOOLS, THEY RISK:

High Delinquency Rates

Without automated reminders and smart collections, borrowers miss payments, and defaults rise.

Inefficient Manual Processes

Without automated payment processing & self-service tools, your team wastes countless hours on avoidable admin work.

Compliance Risks & Fines

Failure to automate compliance tracking can lead to audit failures, fines, and legal trouble.

Poor Borrower Experience & Retention

Manual processes frustrate borrowers—leading them to refinance or switch lenders.

Don’t let inefficiencies limit your profitability.

Have Questions? We’ve Got Answers!

Check out our FAQs for quick answers. Need additional help? Chat with us or schedule a demo to learn more about how our solution fits your lending needs.

What is loan servicing in lending software?

Loan servicing refers to the management of a loan after it has been funded, including payment processing, interest calculations, customer communications, and delinquency management. Infinity Software’s loan servicing software automates these processes to ensure accuracy and efficiency.

How does Infinity Software simplify loan servicing operations?

Infinity Software automates recurring tasks like payment tracking, late fee calculations, and borrower notifications. It provides lenders with real-time data, easy account management, and complete visibility into loan performance across portfolios.

Can Infinity Software handle multiple loan types in servicing?

Yes. Infinity Software supports servicing for multiple loan types, including installment loans, payday loans, consumer loans, auto-title loans, and line-of-credit products, all from a single platform, making it ideal for diverse lenders.

How does loan servicing software help with compliance management?

Infinity Software helps lenders stay compliant by maintaining accurate records, generating audit reports, and automating state and federal compliance rules. It ensures all servicing actions follow regulatory standards.

Can lenders customize payment schedules and servicing workflows?

Yes. Lenders can fully customize payment schedules, grace periods, and workflow rules to match their business models. Infinity Software offers flexibility while maintaining consistency and control.

What kind of reporting features are available in Infinity Software’s loan servicing module?

The platform provides real-time reporting and analytics on payments, delinquency rates, and portfolio performance. Lenders can access dashboards and export reports to monitor business health and make data-driven decisions.

How does Infinity Software enhance the borrower experience during servicing?

Infinity Software ensures borrowers have a seamless experience through automated reminders, self-service portals, and real-time payment tracking, reducing confusion and improving customer retention.

Why should lenders choose Infinity Software for loan servicing?

Infinity Software’s loan servicing software offers end-to-end automation, flexible workflows, and built-in compliance tools, helping lenders efficiently manage loan portfolios while delivering a superior borrower experience.

Short-Term Loan Servicing Should be Automated.

Save time and brain space on loan servicing so you can grow your lending operation.

1200 SW 145th Avenue Suite 310, Pembroke Pines, FL. 33027 United States

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved