SOLUTIONS: LOAN PROCESSING

Accelerate, Automate & Scale Loan Processing with Ease

Loan processing delays lead to frustrated borrowers, lost revenue, and operational inefficiencies. Manual document verification, data entry errors, and compliance risks slow down approvals and create bottlenecks that limit your growth.

With Infinity’s AI-powered Loan Processing Software, you’ll automate document verification, streamline workflows, and process loans in minutes—not days.

ELIMINATE DOCUMENT VERIFICATION BOTTLENECKS

AUTOMATE CREDIT CHECKS & FRAUD DETECTION

ACCELERATE APPLICATION-TO-FUNDING TIME

Smarter, Faster Loan Processing with Powerful Features

AI-Powered

Document Verification

Eliminate paperwork errors and process applications 3x faster with OCR-powered document scanning, e-signatures, and automated borrower verification.

Instant ID &

Credit Checks

Reduce fraud and high-risk applications with real-time credit bureau integrations, KYC verification, and AI-driven fraud detection.

Automated Decisioning & Workflows

Infinity automatically validates borrower data, structures loans based on pre-set rules, and routes applications for approval—without manual intervention.

Built-In Compliance & Risk Management

Stay 100% compliant with TILA, AML, Fair Lending, and state lending laws with automated audit trails, regulatory tracking, and compliance-ready loan structuring.

Easily Integrate With Your Tech Stack

Infinity connects effortlessly with banking platforms, CRMs, credit bureaus, payment processors, and underwriting systems for a frictionless loan processing experience.

Real-Time Loan

Status Tracking

Keep borrowers and your team informed at every stage of the loan process with real-time status updates, automated notifications, and a centralized tracking dashboard—reducing delays and improving customer experience.

Types of Lenders Loving Infinity's

Loan Processing Solutions

Installment

Lenders

Automate application review, document verification, and approval workflows to fund loans faster.

Line-of-credit

LENDERS

Seamlessly verify creditworthiness and manage dynamic credit line adjustments in real time.

hybrid

Lenders

Leverage AI-powered fraud detection, automated underwriting, and instant borrower validation for a frictionless digital lending experience.

consumer

lenders

Streamline lien tracking, collateral verification, and compliance monitoring for secured and unsecured loans.

payday

lenders

Ensure rapid, compliance-ready loan processing with automated approvals and real-time funding.

storefront

lenders

Optimize in-person lending with faster approvals, automated compliance, and seamless payment processing—so you can serve more borrowers with less effort.

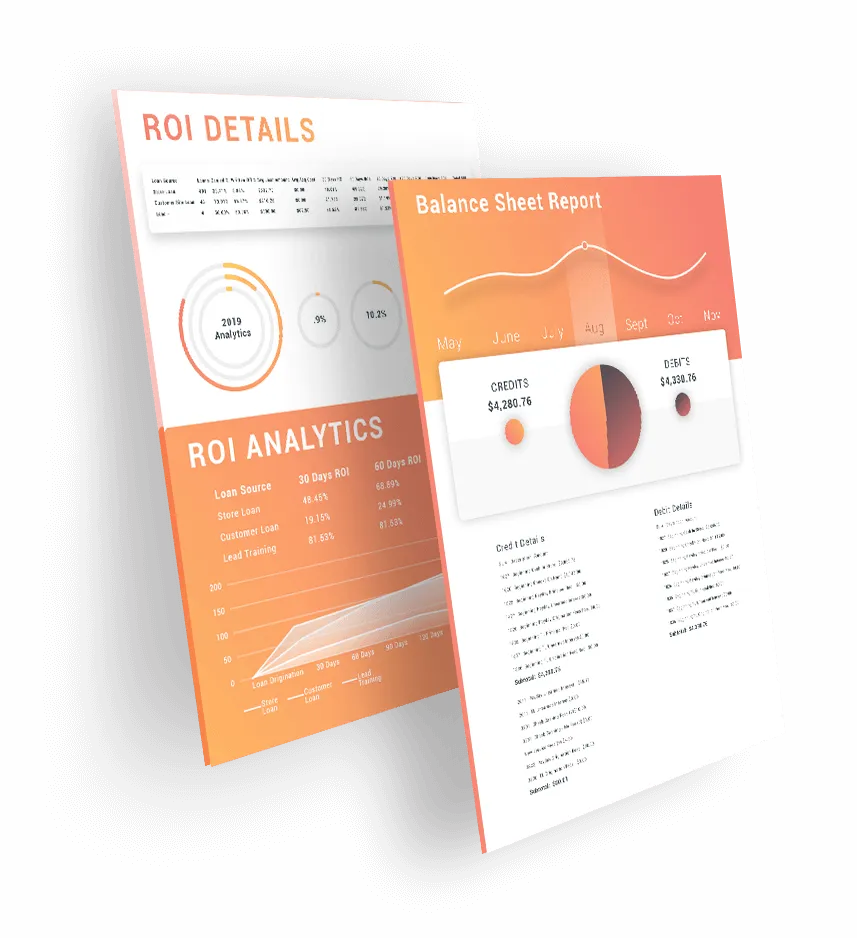

Loan Reporting Solutions for a

Wide Range of Lenders & Loan Types

Automate application review, document verification, and approval workflows to fund loans faster.

Seamlessly verify creditworthiness and manage dynamic credit line adjustments in real time.

Leverage AI-powered fraud detection, automated underwriting, and instant borrower validation for a frictionless digital lending experience.

Streamline lien tracking, collateral verification, and compliance monitoring for secured and unsecured loans.

Ensure rapid, compliance-ready loan processing with automated approvals and real-time funding.

Optimize in-person lending with faster approvals, automated compliance, and seamless payment processing—so you can serve more borrowers with less effort.

What's at Stake?

CHOOSING A LOAN MANAGEMENT SYSTEM WITH SUBOPTIMAL LOAN PROCESSING FEATURES COULD RESULT IN:

Delayed Approvals & Lost Borrowers

Borrowers expect instant decisions—slow processing pushes them to faster competitors.

Higher Fraud & Compliance Risks

Without AI-driven fraud detection and compliance tracking, you expose your business to unnecessary risk and regulatory fines.

Increased Operational Costs

Manual loan processing leads to higher staffing costs, inefficiencies, and lost revenue.

Limited Scalability & Growth

Manual loan processing leads to higher staffing costs, inefficiencies, and lost revenue.

Loan processing is a big job. Why not let the LMS do it

Frequently Asked Questions

LOAN PROCESSING CAN BE A SIMPLE AS A FEW CLICKS.

Question 1: How does Infinity reduce loan processing delays?

Infinity automates application intake, document verification, and decisioning, allowing lenders to process loans in minutes instead of days.

Question 2: Can Infinity verify borrower income and identity automatically?

Yes! Infinity integrates with major credit bureaus, KYC providers, and banking APIs to instantly verify borrower identity, income, and financial history.

Question 3: Does Infinity help prevent fraud during loan processing?

Absolutely. Our AI-powered fraud detection flags suspicious applications, detects duplicate submissions, and identifies high-risk borrowers before funding.

Question 4: How does Infinity ensure compliance in loan processing?

Infinity’s built-in compliance engine tracks regulatory changes, generates audit-ready reports, and ensures every loan meets TILA, AML, and state-specific lending laws.

Question 5: Can I adjust Infinity’s loan processing workflows?

Yes! Configure approval thresholds, underwriting rules, document requirements, and loan structuring to match your business model and risk strategy.

HAVE MORE QUESTIONS? CONTACT US AND GET ANSWERS FROM DEDICATED LENDING EXPERTS.

More Approvals, More Revenue, More Free-Time

Speed up your lending operations with more powerful, robust loan processing software. Save time, lower costs, and start scaling.

1 (954) 678-4600

1200 SW 145th Avenue

Suite 310

Pembroke Pines, FL. 33027

United States

Want to See More?

Follow & Subscribe on our Socials!

Solutions

Loan Types

Sister Links

Company

Resources

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved