SOLUTIONS: LOAN REPORTING

Loan Reporting Software that Puts You in Control

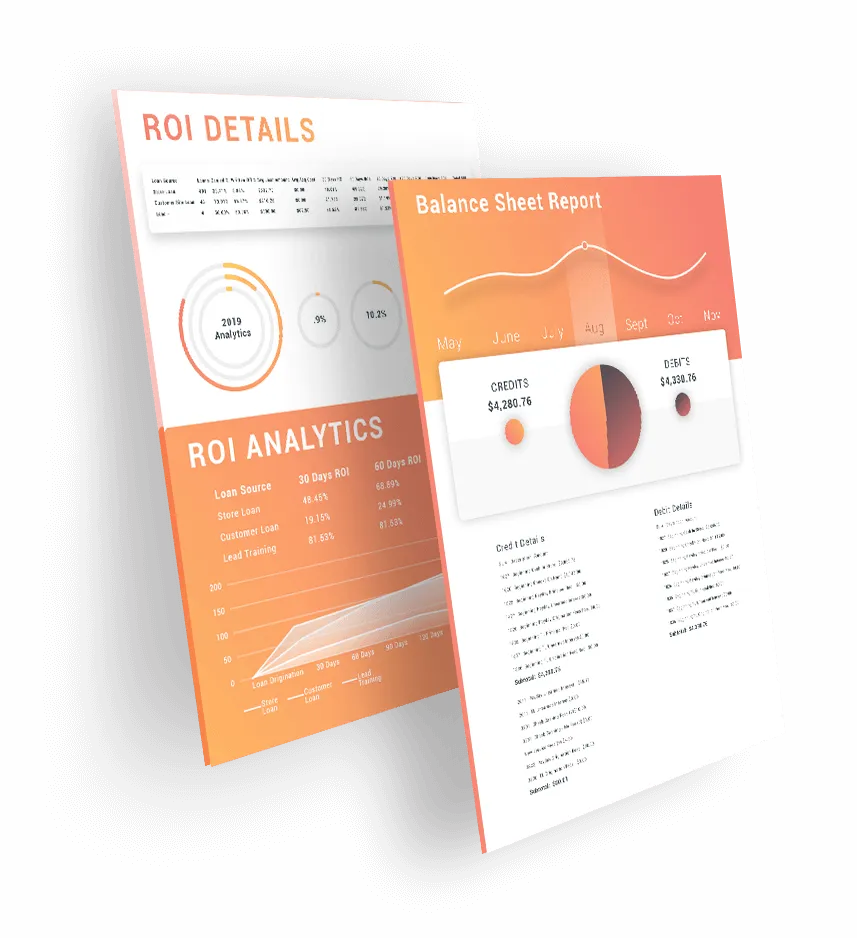

Tracking, analyzing, and optimizing your lending performance shouldn’t be complicated. Infinity’s AI-powered Loan Reporting provides real-time insights, automated compliance tracking, and deep data analytics—so you can scale smarter, reduce risk, and drive profitability.

REAL-TIME REPORTING FOR FASTER DECISIONS

AUTOMATE COMPLIANCE & AUDIT TRACKING

TURN DATA INTO ACTIONABLE INSIGHTS

Loan Reporting that Gives You More Visibility & Actionable Insights

Instant

Portfolio Insights

Monitor loan performance, risk exposure, and borrower behavior in real time. Customizable dashboards and reports help you make informed decisions instantly.

Automated

Compliance Tracking

Stay ahead of regulatory changes with automated tracking for TILA, AML, Fair Lending, and other compliance requirements—so you’re always audit-ready.

Customizable

Reporting Dashboards

Choose from pre-built reports or create your own with Infinity’s advanced report builder. Track KPIs, analyze trends, and optimize lending strategies.

Integrations for

More Complete Data

Sync your loan data with CRMs, accounting platforms, and payment processors for a unified, real-time reporting experience.

Predictive Risk &

Performance Analysis

Use AI-driven forecasting to anticipate defaults, identify high-value borrowers, and improve loan approval strategies.

User-Friendly Interface &

Scheduled Reports

Easily access reports anytime, or schedule automated reports to be delivered to your inbox—no manual effort required.

Loan Reporting Solutions for a

Wide Range of Lenders & Loan Types

Monitor repayment trends, delinquency rates, and portfolio performance in real time.

Track borrower activity, credit utilization, and optimize credit line extensions.

Analyze digital lending performance, customer acquisition costs, and automated loan tracking.

Evaluate collateral valuations, lien tracking, and loan repayment trends.

Gain insights into in-person transactions, payment behaviors, and regulatory compliance.

Ensure compliance with automated reporting for short-term lending regulations and risk tracking.

What's at Stake?

CHOOSING THE WRONG LOAN REPORTING SOLUTION IS COSTLY FOR SHORT-TERM LENDERS.

Poor Visibility = Higher Risk

Without real-time data, lenders make uninformed decisions that increase risk and reduce profitability.

Manual Compliance Tracking = Costly Errors

Regulatory mistakes lead to fines, legal exposure, and operational slowdowns.

Inefficient Reporting = Missed Opportunities

Without automated insights, lenders struggle to optimize strategies and grow profitably.

Disconnected Data = Slower Decision-Making

A lack of system integrations slows reporting and leads to inconsistent insights.

You make major lending decisions based on the data you have available. Make sure it's the right data with Infinity.

Frequently Asked Questions

INFINITY MAKES IT EASY TO GENERATE LOAN REPORTS AND GIVES LENDERS EASY-TO-UNDERSTAND INSIGHTS THEY CAN ACT ON TO INCREASE PROFITABILITY AND MORE.

Question 1: How many reports does Infinity offer?

Infinity provides 400+ pre-built reports, plus a custom report builder for unlimited reporting flexibility.

Question 2: Can I schedule automated reports?

Yes. Infinity allows you to schedule reports for automated delivery to your inbox or team members.

Question 3: Does Infinity's reporting integrate with accounting systems?

Absolutely. Our platform connects seamlessly with QuickBooks, Xero, and other accounting tools.

Question 4: Can I customize the reporting dashboards?

Yes. Infinity’s user-friendly dashboard allows you to customize views, metrics, and data visualizations.

HAVE MORE QUESTIONS? CONTACT US AND GET ANSWERS FROM DEDICATED LENDING EXPERTS.

Don't Rely on Subpar Loan Reporting Tools

Turn loan data into powerful insights. Optimize lending performance, reduce risk, and scale with confidence.

1 (954) 678-4600

1200 SW 145th Avenue

Suite 310

Pembroke Pines, FL. 33027

United States

Want to See More?

Follow & Subscribe on our Socials!

Solutions

Loan Types

Sister Links

Company

Resources

©2026 Infinity Software | A LendSuite Software Brand | All Rights Reserved