1 (954) 678-4600

SOLUTIONS: OVERVIEW

Loan Management Solutions Overview

No more outgrowing your software. No more switching systems when you scale. Infinity is built to help you launch, grow, and dominate. From your very first loan to a thriving portfolio, we automate, simplify, and streamline everything—so you can focus on profits, not processes.

FASTER

LOAN ORIGINATION

MORE

AUTOMATED

SIMPLER

COMPLIANCE

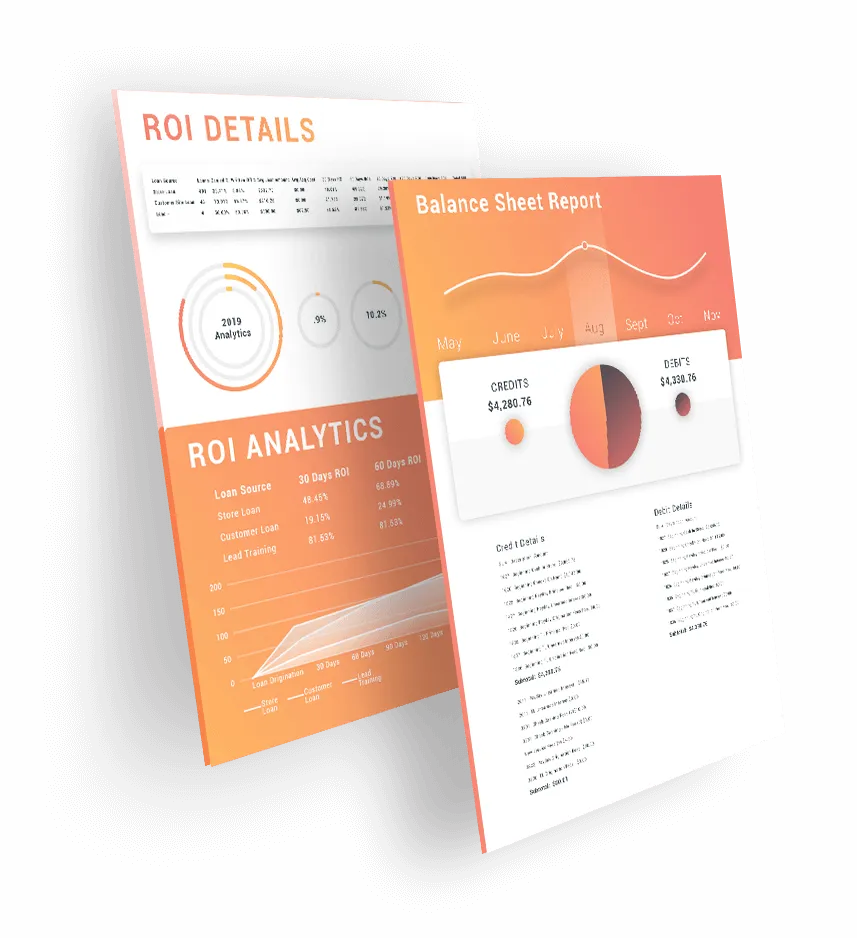

Master the KPIs that Drive

Your Lending Success

Cost Per Funded Loan (CPFL)

Cut operational expenses with automation and reduce per-loan costs.

Loan

Default Rate

Track how many loans go unpaid—spot risk before it hurts your bottom line.

Loan

Approval Rate

Use AI-driven underwriting to approve more good borrowers faster.

Delinquency

Rate

Improve borrower screening and reduce defaults by up to 30 percent.

Know Your Numbers. Scale With Confidence.

Ready to optimize your lending strategy? Let’s Talk.

Everything You Need in

Loan Management Software

A TRUE, ALL-IN-ONE LOAN MANAGEMENT SOLUTION

Infinity Makes Lending Easy

INFINITY MAKES THE LOAN LIFE CYCLE SIMPLE FROM START TO FINISH.

Originate Loans

Instantly

AI-driven application processing and automated underwriting reduce approval times from days to minutes.

Service & Collect

Effortlessly

Keep borrowers on track with automated notifications, digital self-service options, and flexible repayment plans.

Stay Compliant

Automatically

Automated tracking and reporting keep you audit-ready and protect against regulatory risks.

Get Insights to Scale Quickly

Predictive analytics and customizable dashboards help you optimize lending strategies.

It's really that simple.

Who USES Infinity Software?

What's At Stake?

WHAT HAPPENS IF LENDERS RELY ON OUT-DATED LOAN MANAGEMENT SYSTEMS?

You will lose high-intent borrowers to faster, digital-first competitors

Your compliance risks and operational costs will increase

Manual inefficiencies will keep your team buried in paperwork

It doesn't have to be this way!

Frequently Asked Questions

Question 1: How fast can I launch using Infinity Software lending platform?

Most lenders go live in 30 to 60 days with our easy implementation process.

Question 2: Does Infinity integrate with my current systems?

Yes. Our open API structure seamlessly connects with core banking, CRM, credit bureaus, and payment processors.

Question 3: Is Infinity scalable or will I have to switch to a different LMS when I grow?

Absolutely! Infinity’s loan management software was designed to support your growth every step of the way. Whether you’re funding your first loan or managing a rapidly expanding portfolio, Infinity scales with you—no need to switch systems as you grow. their

HAVE MORE QUESTIONS? CONTACT US AND GET ANSWERS FROM DEDICATED LENDING EXPERTS.

Is it Easy to Switch to Infinity?

IT'S SIMPLE 3-STEP PROCESS TO SWITCH TO INFINITY.

1.

We Handle Setup & Integration

Our team connects Infinity to your credit bureaus, CRMs, and banking platforms.

2.

Migrate With

Zero Downtime

Securely transfer borrower records and underwriting rules.

3.

Go Live Within

30 Days

Start funding loans faster with hands-on training and 24/7 support.

Why wait? Contact us or schedule a demo today.

Simplify and Automate Your Short-Term Lending Processes & Dominate

Take the first step towards more profitable lending processes that save you time, energy, and money.

Contact Us

P: 1 (954) 678-4600

1200 SW 145th Ave

Suite 310

Pembroke Pines, FL. 33027

USA

Site Links

Sister Links

Follow Us

©2025 Infinity Software | A LendSuite Software Brand | All Rights Reserved