Short-Term Lending Software

that Actually Solves Your Problems

If you're a short-term lender, you know the pain:

• Applications stacking up but approvals lagging behind

• Borrowers ghosting you mid-process

• Compliance requirements shifting faster than you can keep up

• Payment reminders missed, delinquencies up

• Your team stuck doing manual work that software should be handling

Infinity was built to fix all of that—fast.

INFINITY SOFTWARE

Why More Lenders Are Switching to Infinity in 2025

Short-term lending is fast—but your tech might be slowing you down. Legacy systems, manual work, and compliance chaos are killing your ROI. Infinity is the modern lending OS built to streamline every step—from approval to repayment—so you fund faster, reduce risk, and grow without limits.

Instant Approvals. More Loans. Less Drop-Off

AI-Powered Underwriting That Works in Seconds

Make instant credit decisions with smart automation

Pre-filled, mobile-first applications reduce friction and ghosting

Built-in e-signatures let borrowers fund on the spot

Boosts: Approval Rate, Time to Fund, Completed Applications

Predict Risk.

Prevent Defaults.

Advanced Analytics to Safeguard Your Portfolio

Spot high-risk borrowers before they get approved

Trigger payment reminders automatically

Monitor repayment risk in real time

Boosts: Repayment Rate, Default Rate, Portfolio Health

Cut Costs,

Without Cutting Corners

Automated Workflows That Lower Your CPL

Automate servicing, communications, and collections

Central dashboard for full borrower lifecycle management

Eliminate bottlenecks and manual handoffs

Boosts: Cost Per Funded Loan, Loans per Team Member, Operational Efficiency

Stress-Free Compliance

Even in Texas

Audit-Ready Compliance Built Into the Core

Pre-loaded state-specific rules, including Texas CSO/CAB

Real-time disclosure updates and fee structures

One-click reporting for confident audits

Boosts: Audit Confidence, Legal Readiness, Compliance Efficiency

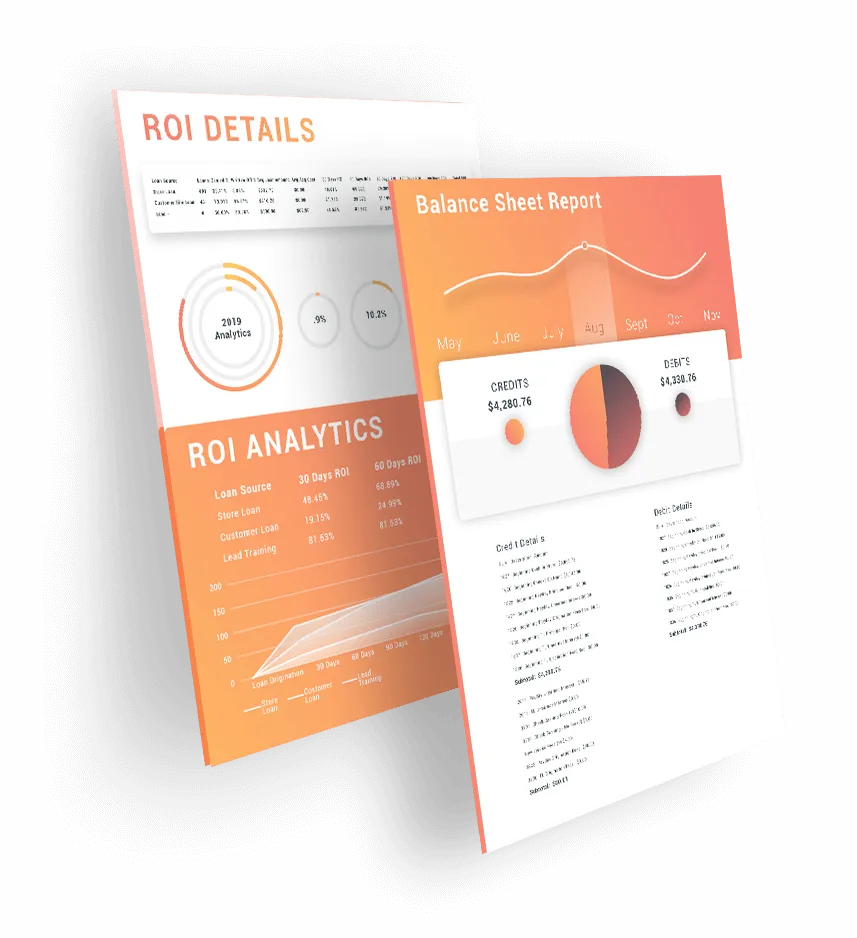

What's Killing Your Lending ROI

And How Infinity Fixes It

Low Approval Rates & High Drop-Off

Manual underwriting slows you down and costs you good borrowers.

Infinity's Solution:

AI-powered underwriting that delivers instant credit decisions

Pre-filled, mobile-first applications that reduce friction and increase completions

Integrated e-signatures so borrowers can accept and fund immediately

Your KPI Boost:

Approval Rate

Abandonment Rate

Time to Fund

Rising Default Rates

Approving too fast—or not spotting risk? That’s a formula for portfolio damage.

Infinity's Solution:

Predictive analytics identify high-risk borrowers before you approve

Automated repayment reminders reduce missed payments

Real-time risk monitoring to act before things go south

Your KPI Boost:

Default Rate

Repayment Rate

Collection Costs

Compliance Headaches (Especially for Texas Lenders)

Manual underwriting slows you down and costs you good borrowers.

Infinity's Solution:

Built-in compliance for payday, installment, line of credit, CSO/CAB

Auto-updated fee structures and disclosures per state

Audit-ready reports at the click of a button

Your KPI Boost:

Time Spent on Compliance

Legal Risk

Audit Confidence

Inefficient Workflows and High CPL (Cost Per Funded Loan)

If your team is buried in spreadsheets and manual steps, you're bleeding time and money.

Infinity's Solution:

Automated approvals, servicing, collections and communications

Centralized dashboard to manage the entire borrower lifecycle

Advanced workflow tools that cut out manual handoffs

Your KPI Boost:

Cost Per Funded Loan (CPFL)

Loans Funded per FTE

Operational Efficiency

What You Get With Infinity

Loan Types We Support Out of the Box

Payday

Loans

Installment

Loans

CSO/CAB

Loans

(Texas-Ready)

Line-of-Credit

Loans

Auto Title

Loans

Cash

Advance

Buy Now

Pay Later (BNPL)

Hybrid or Storefront

Loans

Consumer

Loans

More Online

Loans

Need something tailored? Contact Infinity today!

Built to Scale WITH You

(Not Against You)

Other platforms limit you with cookie-cutter setups and tech roadblocks.

Infinity grows as you grow—whether you’re adding loan types, expanding states, or shifting from storefront to online.

No-Code

Tools

To build your loan products and workflows your way

Powerful

API Access

To connect your CRM, payment systems and lead vendors

Omnichannel

Support

To connect your CRM, payment systems and lead vendors

From real-world lending experts to set you up for sustained success

Save Time. Reduce Risk. Scale Faster.

Don't Just Take Our Word for It

“Infinity cut our time to fund by 62%—and our CPL by 46%. Our team now does twice the volume without working overtime.”

“Default rate down. Approvals up. Our portfolio’s never been stronger.”

“We went from storefront-only to full omnichannel in 10 days. Infinity handled the transition from start to finish.”

Let's Talk Outcomes, Not Just Software

Most platforms show you features. We'll show you ROI.

KPI

Before Infinity

After Infinity

Approval Rate

58%

81%

Time to Fund

36 hours

24 hours

Default Rate

24%

15%

Cost Per Funded Loan (CPFL)

$138

$82

Repayment Rate

68%

89%

Optimize the lending KPIs that matter with Infinity Software.

Ready to See Infinity in Action?

Have more questions? Connect with a real-world lending expert today!

© Copyright 2025. Infinity Software. All rights reserved.